Toyota Guaranteed Auto Protection Program

The Toyota Guaranteed Auto Protection (GAP) Program

provides retail or lease customers with one very significant benefit - peace of mind. This peace of mind comes from knowing that you and your family are protected from the burden of an unexpected financial obligation if your vehicle is declared a total loss.

FILLING THE GAP

Guaranteed Auto Protection (GAP) will waive or pay the deficiency balance (minus certain fees and charges) between the amount still due on your finance or lease contract and your auto insurance settlement.1 In most states, GAP will cover your auto insurance deductible.2

What Your Auto Insurance Company May Pay

You might assume that your physical damage auto insurance is sufficient to cover any losses related to your vehicle.

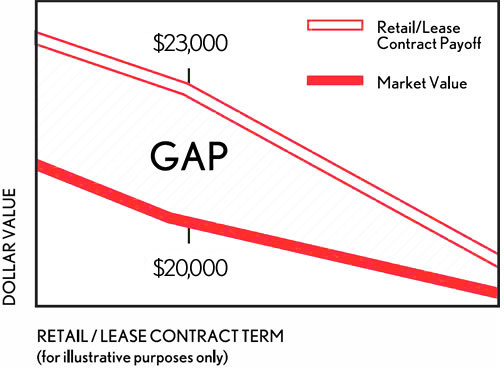

However, when a vehicle is declared a total loss, the primary auto insurance settlement is generally based on the market value of the vehicle, which may be substantially less than the balance still owed on your finance or lease contract for the vehicle.3 This difference is called the deficiency balance, which the vehicle owner is generally responsible for.

Get a grip on GAP

Here's how GAP works: In the event of a total vehicle loss, GAP covers you once insurance has paid its share, paying the difference (or deficiency) between your Toyota's insurance payment (usually market value) and the balance on your finance or lease contract. GAP will also pay up to $1,000 of your auto insurance deductible (if applicable) in most states.

Take a look at the chart here for an idea of GAP coverage in action.

Ask Us Now

Ask your dealer about GAP (offered by Toyota Financial Services) now because it's only available from your dealer at the time you purchase or lease an eligible new or used vehicle. And, for your convenience, the cost of GAP can be added to your finance or lease contract and included as a portion of your monthly payments (subject to credit approval).4 GAP is available in most states

1. Less any delinquent payments, taxes, and past due charges. See agreement, certificate, or waiver for complete details. Some restrictions apply.

2. Available in most states if it is purchased and disclosed separately on the finance/lease contract. See agreement, certificate, or waiver for complete details.

3. See your auto insurance policy for actual coverage in the event of a total loss.

4. Not all customers will qualify.